Singapore received the highest proportion (45.6%) of overseas investment among Asia-Pacific markets in Q1 2024 – Knight Frank

Contact

Singapore received the highest proportion (45.6%) of overseas investment among Asia-Pacific markets in Q1 2024 – Knight Frank

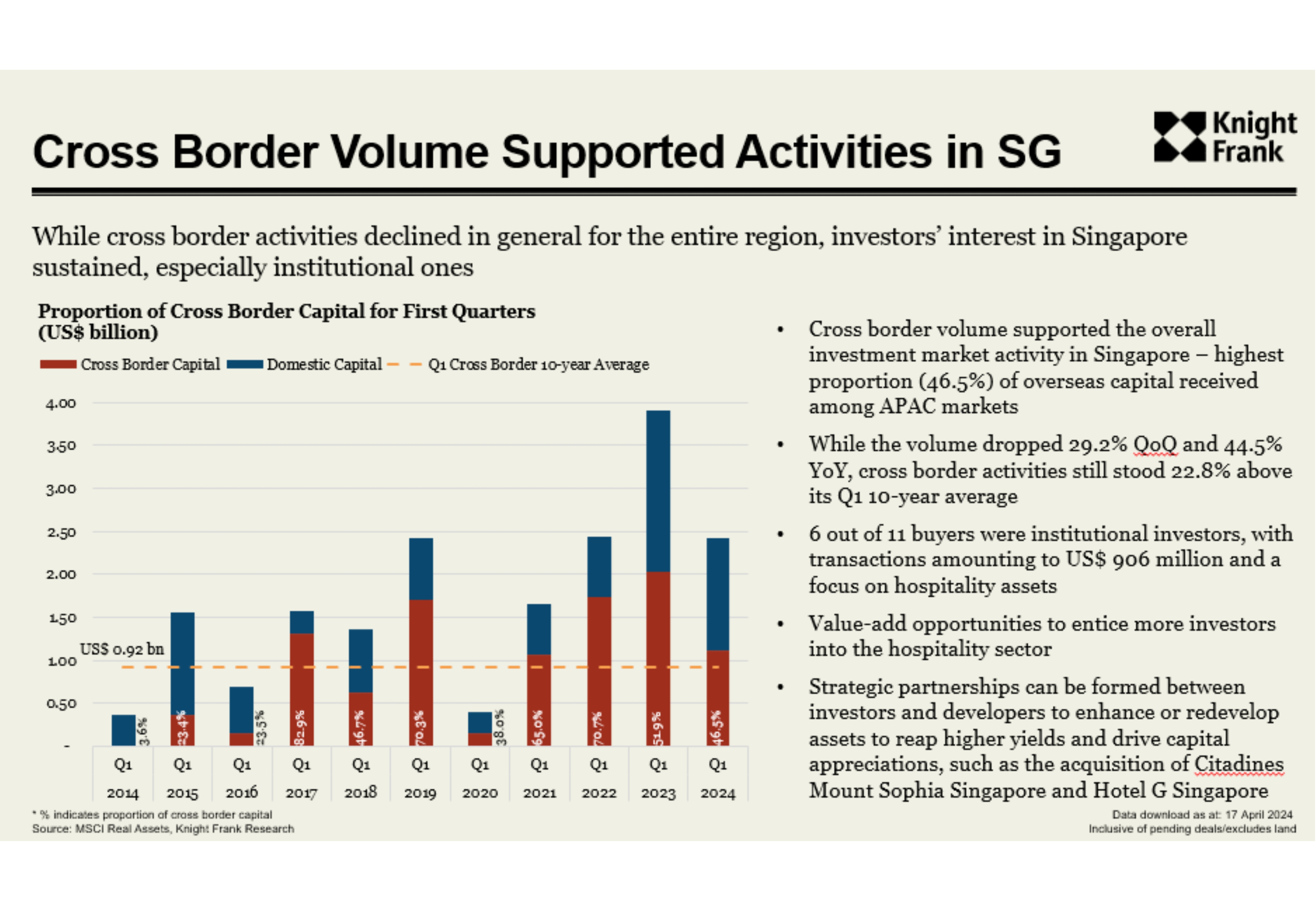

In the first quarter of 2024, Singapore experienced a significant increase in cross-border investment, outpacing the Asia-Pacific region with a 22.8% rise above the 10-year average, contributing US$906 million mainly in the hospitality sector, according to Knight Frank.

Cross-border investment in Singapore strengthened significantly in the first quarter of 2024, rising 22.8% above the 10-year average, according to an analysis by Knight Frank’s Asia-Pacific research team. Cross-border capital supported overall investment market activity, with Singapore receiving the highest proportion (45.6%) of overseas capital among Asia-Pacific markets during the quarter.

Institutional investors played a significant role, accounting for six of the 11 buyers and contributing US$906 million in transactions. This group's strong demand in the hospitality sector was a key driver of the growth. The resurgence of the tourism industry and increased acquisition activity in Singapore's hospitality market further stimulated investors' interest in hospitality assets.

Christine Li, head of research, Asia-Pacific at Knight Frank says, “Our research shows that in the face of a 29% quarter-on-quarter decline in cross-border activities across Asia-Pacific, Singapore bucked this trend. The hospitality sector attracted significant interest from institutional investors with its optimistic outlook and improving operational metrics. The market is ripe for increased investment activity, as investors are particularly drawn to value-added opportunities, signalling potential growth and development within this sector.”

The MICE (meetings, incentives, conventions, and exhibitions) sector and government initiatives such as the China-Singapore 30-Day Mutual Visa Exemption have been instrumental in driving tourism demand.

Christine adds, “Strategic partnerships between investors and developers are emerging to capitalise on the potential for increased investment activity in Singapore's hospitality sector. These collaborations aim to enhance or redevelop existing assets, driving higher yields and capital appreciation - a trend that gained momentum in the first quarter. By joining forces, investors and developers can unlock value in prime hospitality assets through strategic repositioning.”

She highlights two notable examples: the acquisition of Citadines Mount Sophia Singapore and Hotel G Singapore, both of which will undergo rebranding and asset enhancements to maximise their market potential.

South Korea and Japan power office investment resurgence

While the overall trend in cross-border investment volumes across Asia-Pacific experiences a downturn, South Korea and Japan have attracted renewed commercial investment interest, particularly in the office sector.

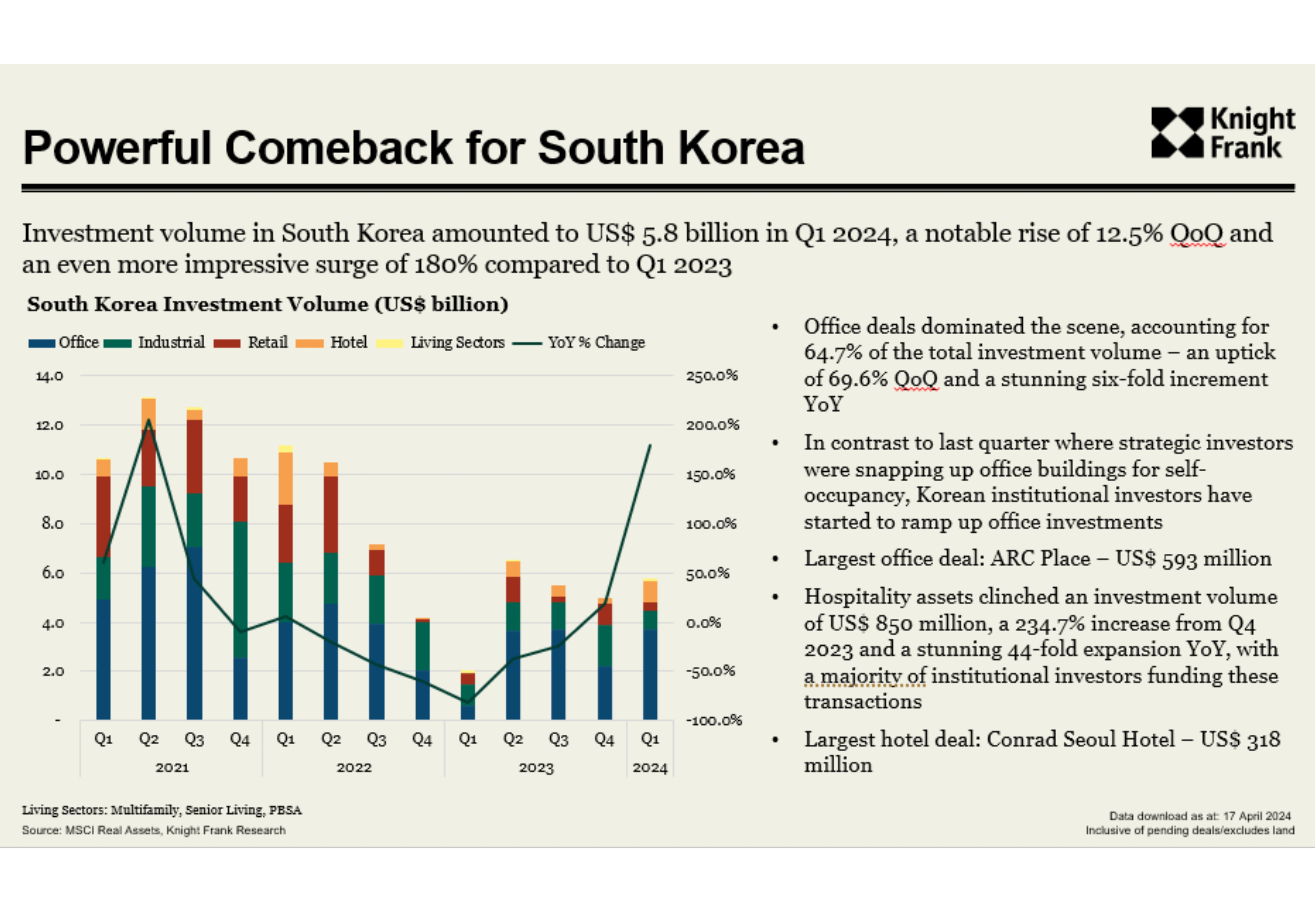

In South Korea, investment volume reached US$ 5.8 billion with a 12.5% quarter-on-quarter rise and 180% year-on-year increase compared with Q1 2023.

- Office deals dominated the market, accounting for 64.7% of the total investment volume – with a 69.6% quarter-on-quarter rise and a six-fold year-on-year increase

- Shift from self-occupancy acquisitions by strategic investors to increased office investments by Korean institutional investors

- Hospitality assets attracted US$ 850 million in investment, marking a 234.7% increase from Q4 2023 and a 44-fold year-on-year expansion, primarily funded by institutional investors

Neil Brookes, global head of capital markets at Knight Frank says, “The re-emergence of domestic institutional investors signals their potential role in shaping the market's future. However, their influence may be tempered by the challenge of negative leverage. Simultaneously, foreign investors are maintaining a cautious approach, awaiting price adjustments before actively pursuing transactions. Discrepancies in pricing expectations between buyers and sellers could delay deal closures, further affecting market activity. This trend will likely continue until substantial interest rate and liquidity improvements become evident. “

Traditional assets in focus for Japan

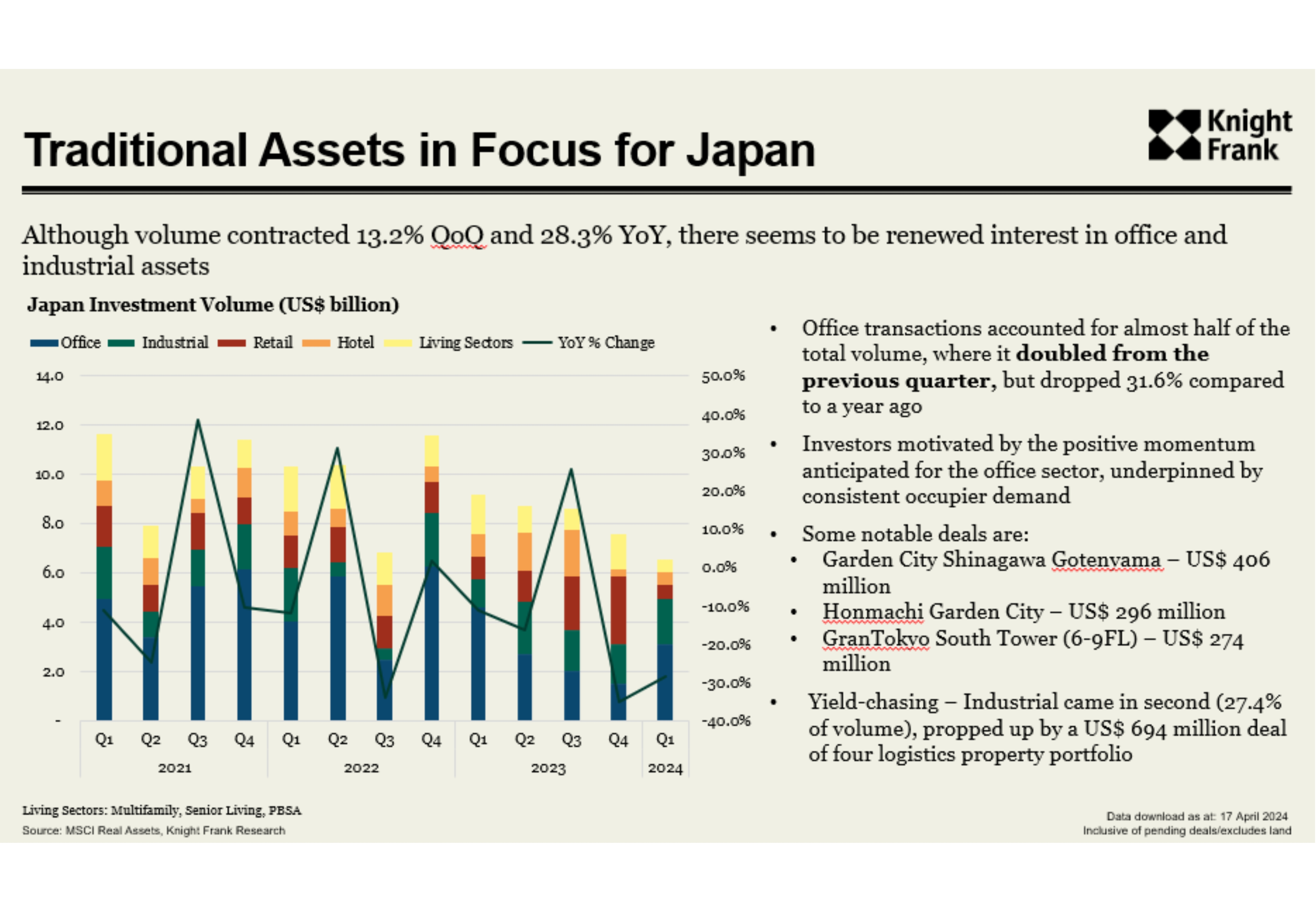

Despite an overall contraction in real estate investment volume, with a 13.2% quarter-on-quarter and 28.3% year-on-year decline, Japan is witnessing renewed investor interest in office and industrial assets.

- Office transactions accounted for almost half of the total volume, which doubled from the previous quarter but dropped 31.6% year-on-year

- Investors are motivated by the positive momentum anticipated for the office sector, underpinned by consistent occupier demand

- Yield-chasing industrial sector ranked second at 27.4% of volume, driven by a US$ 694 million logistics portfolio deal

Neil adds, “Despite the Bank of Japan's recent decision to raise short-term interest rates to 0-0.1% in March 2024, the overall investment climate is not expected to change drastically, and a steady capital inflow into the real estate sector is anticipated to continue. However, if long-term interest rates experience further hikes, investors might demand higher capitalisation rates in sectors such as office, facing stagnant market rents. This could lead to a widening gap between sellers' asking prices and buyers' offers, potentially hindering transaction volume and affecting overall market liquidity.

The shift in Japan's monetary policy could also impact exchange rates, with fluctuations in the Japanese Yen's value possibly encouraging cross-border investments as assets become more affordable in investors' home currencies. As a result, strategic partnerships and targeted investment approaches will be critical in capitalising on market opportunities.”

For further information, please contact Christine Li, Head of Research, Asia-Pacific, Knight Frank as the details below.