Office fit-out costs across Asia Pacific increase slightly, up 0.5% year-on-year: JLL

Contact

Office fit-out costs across Asia Pacific increase slightly, up 0.5% year-on-year: JLL

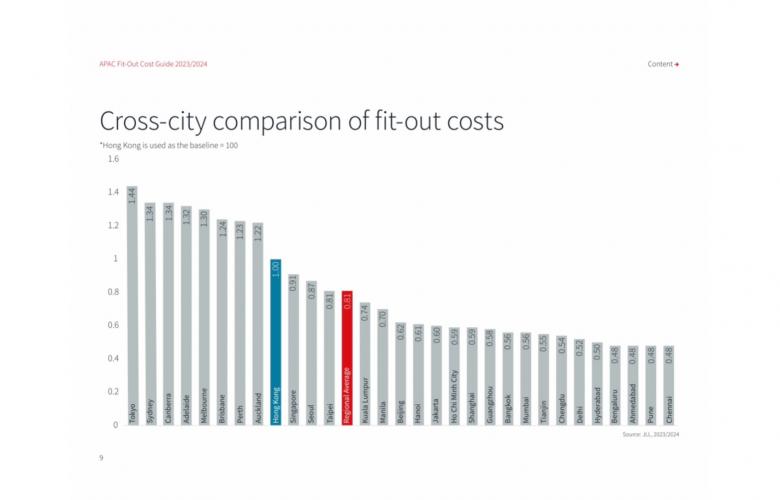

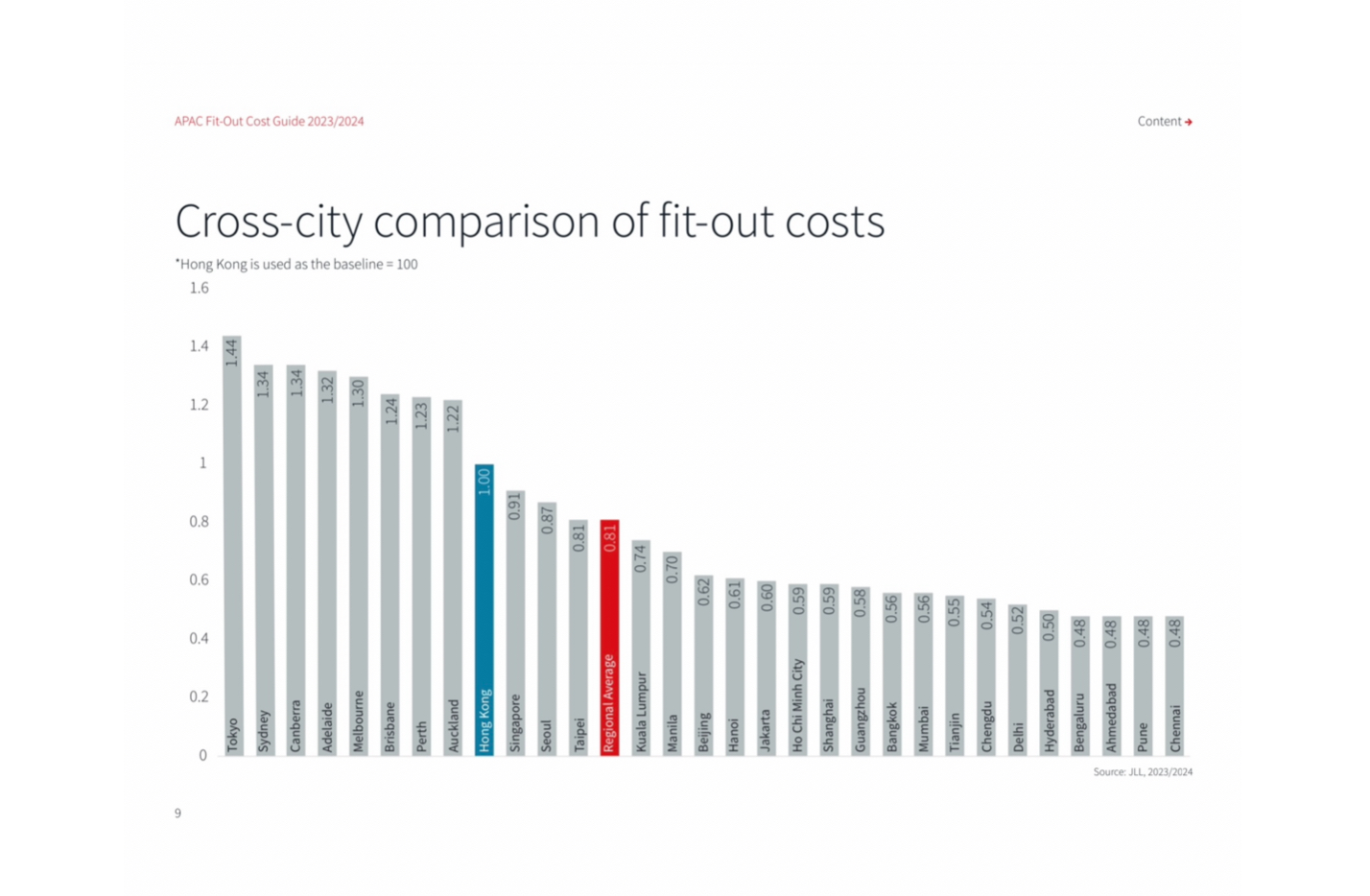

Tokyo overtakes Sydney as the most expensive city for office fit-outs as the cost to fit-out workplaces in Asia Pacific continues to rise, mirroring ongoing inflationary pressures, higher commodity prices and increased construction costs. According to global real estate consultant JLL’s (NYSE:JLL) Asia Pacific Fit-Out Cost Guide 2023/2024.

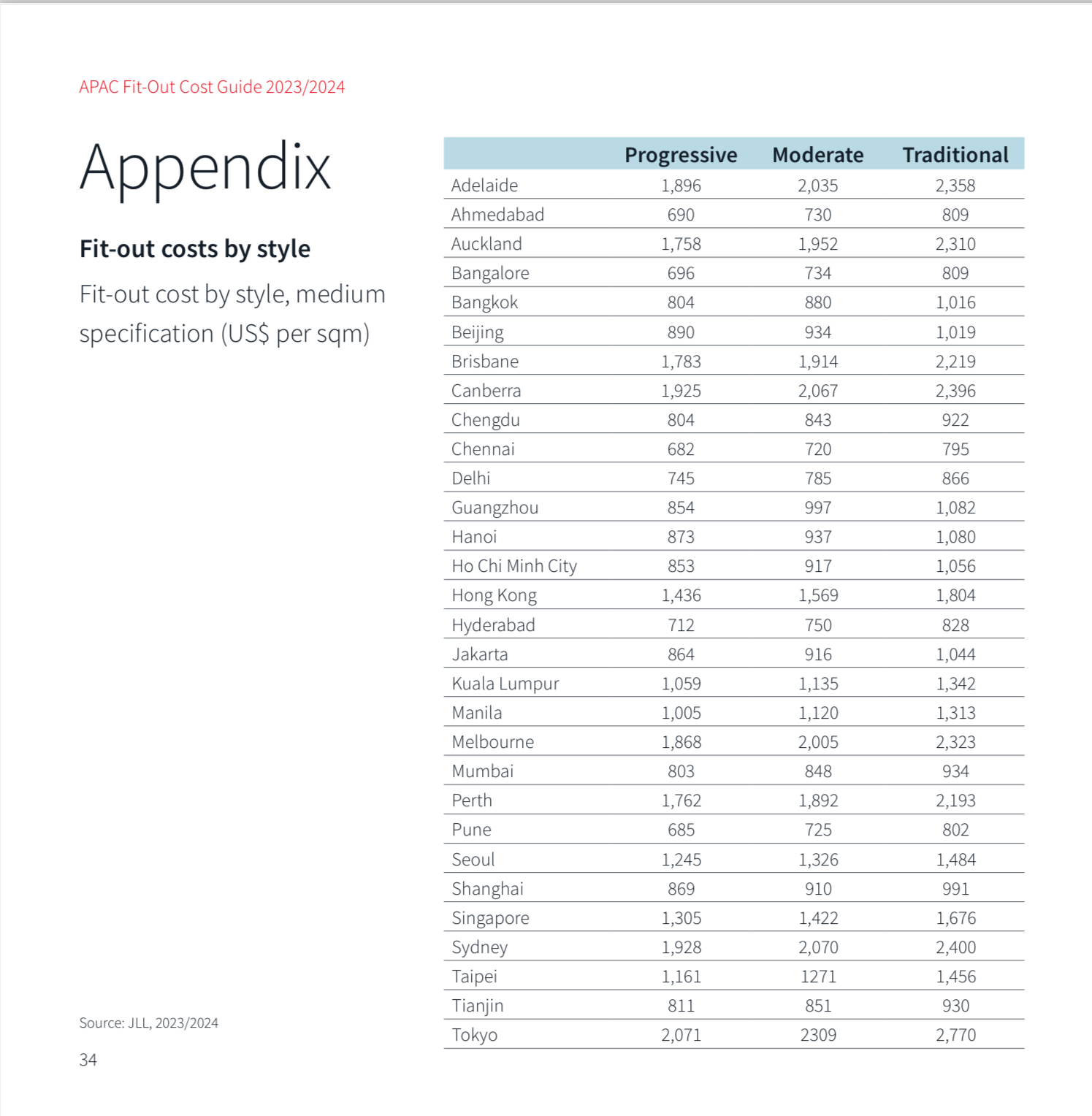

According to global real estate consultant JLL’s (NYSE:JLL) Asia Pacific Fit-Out Cost Guide 2023/2024, the average cost to fit-out workplaces across the Asia Pacific region increased 0.5% year- on-year with the average fit-out cost per sqm rising to US$1,161, up from US$1,159 last year.

After losing its spot to Sydney in last year’s guide, Tokyo has regained its place as the most expensive city in Asia Pacific for office fit-outs at US$2,071 per sqm. Inflationary pressure is having an impact on project pipelines, but despite a 20% rise in construction prices at a local currency level, confidence remains in the market as the flight to quality in workplaces remains a theme in Tokyo.

Australian markets follow Tokyo as the next most expensive including Sydney (US$1,929), Canberra (US$1,926), Adelaide (US$1,897) and Melbourne (US$1,868). These markets continued to show increases in construction prices, but previous high levels of inflation have tailed off in line with projections.

Whilst overall construction prices at a regional level have shifted by 0.5% year-on-year in US dollar terms, at a local currency level, most markets have reported increases. The exceptions are markets in China and Vietnam, which saw largely static construction prices in response to weakened client confidence driving increased competition for work in these locations. Since abandoning the “zero Covid” strategy, China has not experienced the sharp growth in pent up demand that was prevalent in other markets post pandemic.

Martin Hinge, Executive Managing Director, Project Development Services, JLL Asia Pacific, says, “Inflation in Asia Pacific markets is returning to normal levels as widely projected, but certain supply chain challenges remain for mechanical, engineering and plumbing, information technology and audio-visual items. Going forward, we foresee factors like commodity process, energy costs, and wage increases will continue to impact pricing and lead to delays for some fit-outs and unpredictability of select items into Asia Pacific. We have also seen significant exchange rate volatility over the last 12 months, in some cases eroding tender price increases in local currencies.”

On the supply chain front, two-thirds of JLL’s Asia Pacific market leaders are citing constraints in mechanical and electrical (M&E), IT, audio visual (AV) and security trades. This is expected to continue improving over the coming 12 months as supply chains continue to adapt and, in some markets, demand softens.

Hinge adds, “Nonetheless, our clients continue to remain bullish. In most markets, sentiment remains strong and despite the continuing impact of price inflation, our teams report robust pipelines due to a renewed focus by clients to attract staff back to the office, improve productivity and well-being, and meet net zero carbon (NZC) commitments.”

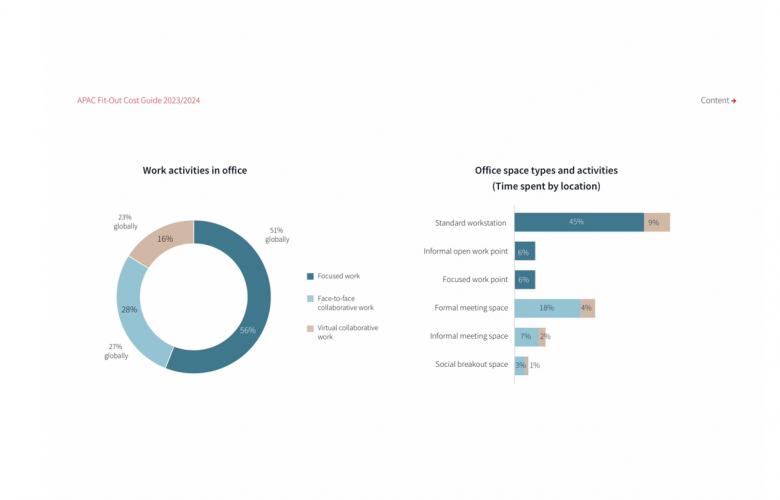

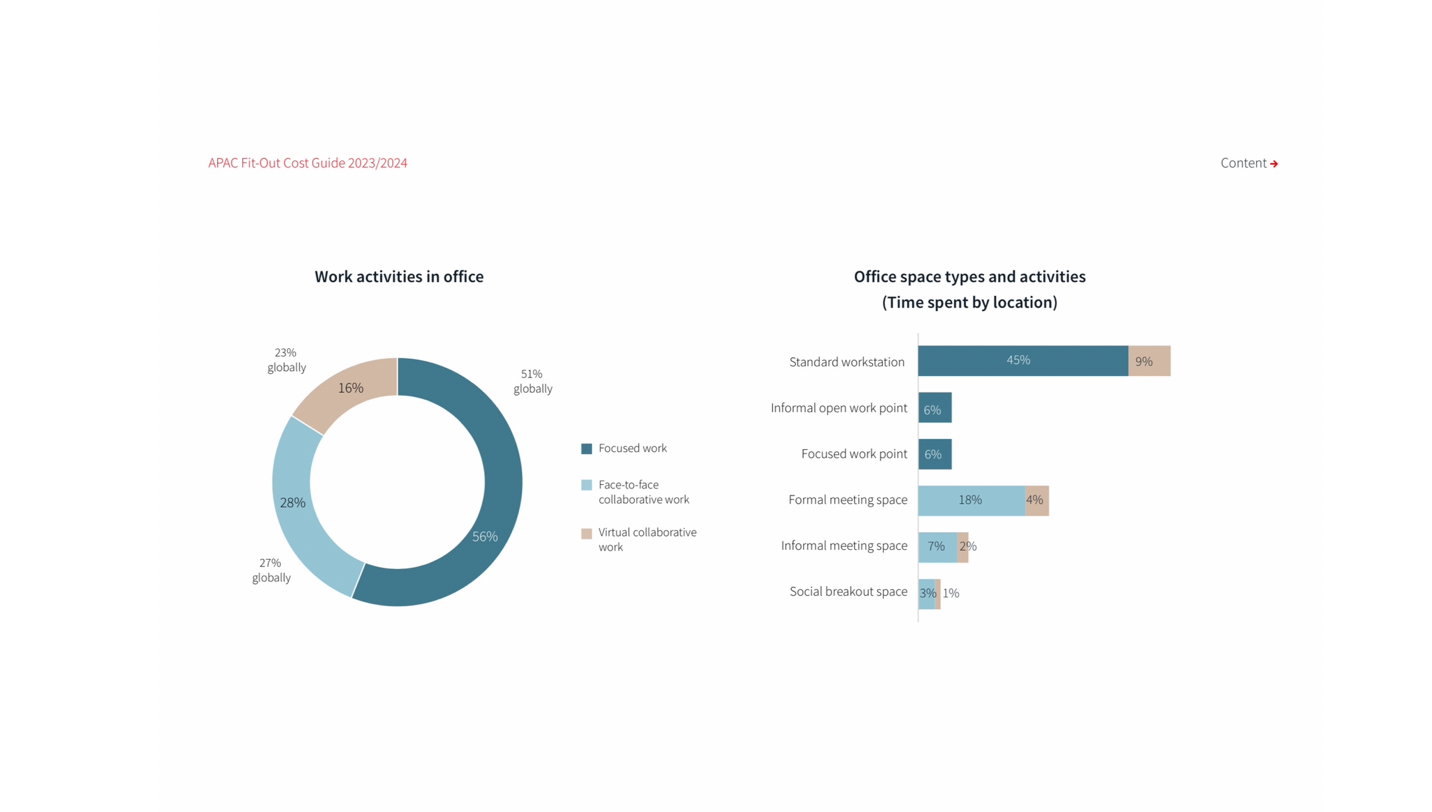

As the flight to quality trend continues there is a need to balance return to office mandates with the need to design and maintain hybrid, human-centric workspaces. Considerations include spaces that attract and retain talent, meet ESG aspirations, and provide environments that meet employees demands and the variety of work activities undertaken throughout the working day.

Sustainability remains front of mind:

Leasing office space in sustainable buildings is becoming non-negotiable for occupiers committed to ESG. Among other factors, sustainable fit-outs are gaining prominence as an initiative to decarbonise workplaces. In a survey of 240 commercial real estate leaders across Asia Pacific, one-in-two cite sustainable fit-outs as a priority to be actioned within the next three years. This confirms that sustainability is now a key driver in the way occupiers acquire, fit-out, and manage their assets.

While ESG commitments are a key driver of sustainable fit-outs, cost savings over the long term can offset upfront capital expenditure (CAPEX) costs. Sustainable materials or pieces of equipment may be more expensive upfront but those with better energy ratings or longer lifespans will save businesses money in the long run.

Responding to inflationary pressures that projects are facing, one-third of JLL market leaders in Asia Pacific report that pursuing a sustainable design is dependent on the overall project cost and 56% confirmed that reduced CAPEX on initiatives was being considered as a means to work within budgets, the bulk of which was in Australia and Southeast Asian markets.

To request a copy of the JLL Asia Pacific Fit-Out Cost Guide 2023/2024 please email Martin Hinge Executive Managing Director Project and Development Services JLL, Asia Pacific via the below contact details.

Related Reading:

Commercial real estate to remain attractive to investors in the long term: JLL

CBRE launches Hong Kong Real Estate Market Outlook 2024 - Retalk Asia

Colliers launches 2024 Global Investor Outlook - Retalk Asia

JLL Appoints Jaime Kernaghan Head of Office Leasing – Northern Sydney - COMMO

Email Martin Hinge Executive Managing Director Project and Development Services JLL, Asia Pacific via the below contact details.